|

|||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

How Is Lockheed Martin's Stock Performance Compared to Other Aerospace & Defense Stocks?/Lockheed%20Martin%20Corp_%20TX%20facility-by%20JHVEPhpoto%20via%20iStock.jpg)

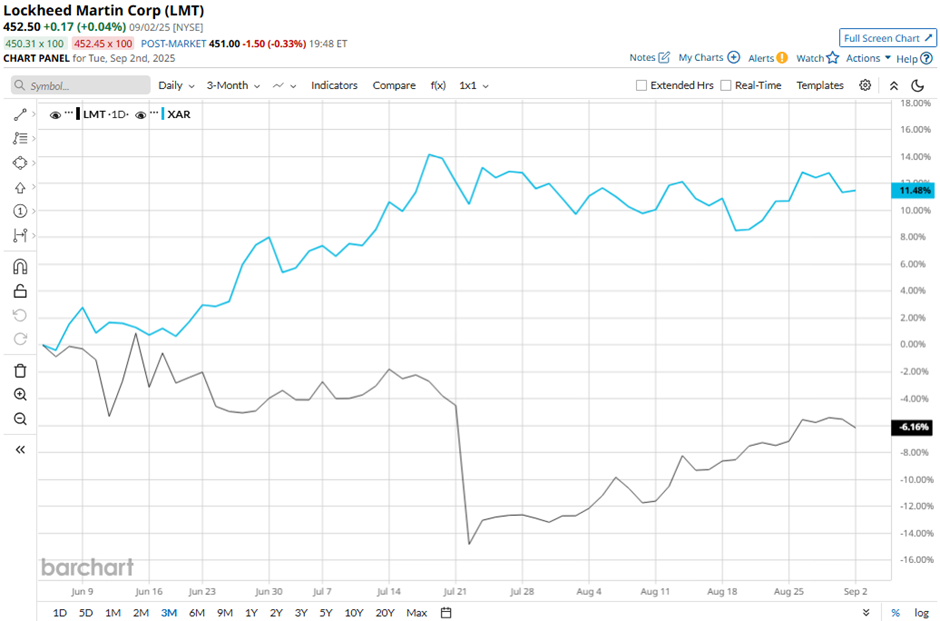

With a market cap of $106.4 billion, Lockheed Martin Corporation (LMT) is the world’s largest defense contractor specializing in aerospace, defense, space, intelligence, and advanced technology solutions. The company operates through four core segments: Aeronautics; Missiles and Fire Control (MFC); Rotary and Mission Systems (RMS); and Space. Companies valued over $10 billion are generally described as “large-cap” stocks, and Lockheed Martin fits right into that category. Its primary customers include the U.S. government, allied international partners, and foreign military sales contracted through the U.S. government, all relying on Lockheed Martin to deliver advanced security and innovation. Shares of the Bethesda, Maryland-based company have decreased 26.9% from its 52-week high of $618.95. Lockheed Martin’s shares have fallen 15.5% over the past three months, underperforming the SPDR S&P Aerospace & Defense ETF’s (XAR) 13.3% gain over the same time frame.

In the longer term, LMT stock is down 6.9% on a YTD basis, lagging behind XAR’s 31.3% increase. In addition, shares of the aerospace and defense company have declined 20.4% over the past 52 weeks, compared to XAR’s 40% surge over the same time frame. LMT stock has been trading below its 200-day moving average since December last year.

Despite stronger-than-expected Q2 2025 adjusted EPS of $7.29, Lockheed Martin’s shares tumbled 10.8% on Jul. 22 as its reported profit plunged around 80% to $342 million, or $1.46 per share, largely due to $1.6 billion in pretax charges tied to a classified Aeronautics program and international helicopter losses. The company also cut its 2025 operating profit outlook by $1.5 billion, to $6.65 billion. Additional concerns included quarterly revenue of $18.2 billion, which missed Street forecasts. Moreover, LMT stock has lagged behind its rival, General Dynamics Corporation (GD). GD stock has returned 23.1% on a YTD basis and 8.4% over the past 52 weeks. Despite the stock’s underperformance, analysts remain moderately optimistic about its prospects. LMT stock has a consensus rating of “Moderate Buy” from 24 analysts' coverage, and the mean price target of $491.45 is a premium of 8.6% to current levels. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|