|

|||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Boston Scientific Stock Outperforming the S&P 500?/Boston%20Scientific%20Corp_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

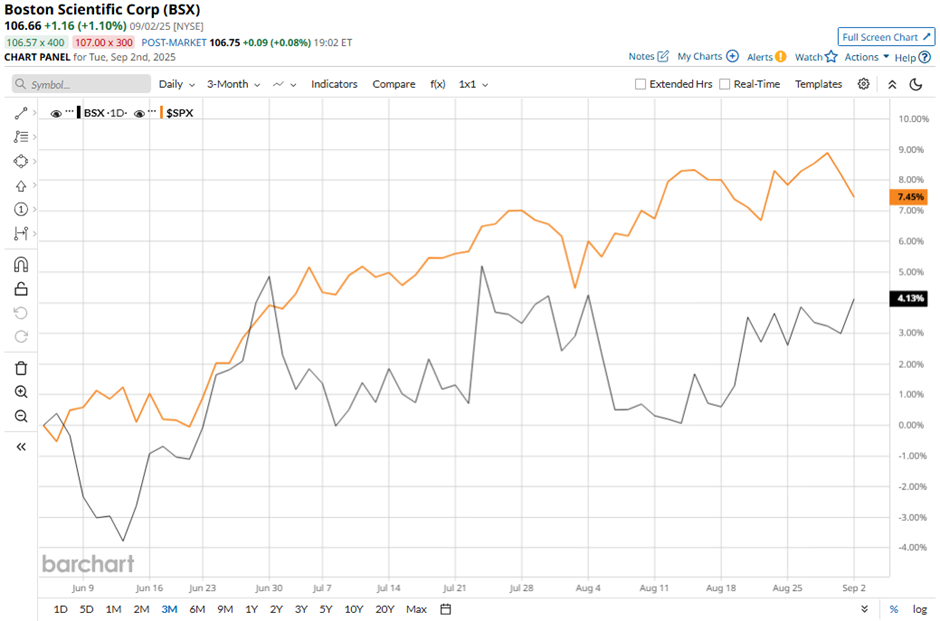

With a market cap of $156.3 billion, Boston Scientific Corporation (BSX) is a leading global developer, manufacturer, and marketer of medical devices. The company operates across key segments, including Cardiovascular, Rhythm & Neuro, and MedSurg, offering innovative solutions for heart disease, chronic pain, gastrointestinal, urological, and neurological conditions. Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Boston Scientific fits this criterion perfectly. With a diverse portfolio of internally developed and acquired technologies, Boston Scientific leverages both organic innovation and strategic acquisitions to drive growth worldwide. Shares of the Marlborough, Massachusetts-based company have pulled back 2.1% from its 52-week high of $108.94. Boston Scientific’s shares have risen 2.4% over the past three months, underperforming the broader S&P 500 Index’s ($SPX) 8.1% gain over the same time frame.

In the longer term, BSX stock is up 19.4% on a YTD basis, exceeding SPX’s 9.1% increase. Moreover, shares of the medical device manufacturer have climbed 30.4% over the past 52 weeks, compared to the 13.6% return of the SPX over the same time frame. Despite a few fluctuations, BSX stock has been trading mostly above its 50-day and 200-day moving averages since last year.

Shares of Boston Scientific surged 4.5% on Jul. 23 after the company reported better-than-expected Q2 2025 adjusted EPS of $0.75 and revenue of $5.1 billion. Management raised its 2025 adjusted profit outlook to $2.95 per share - $2.99 per share while cutting expected tariff-related costs in half to about $100 million. Strong demand for key cardiovascular devices like Watchman and Farapulse, supported by favorable trial results and expanded indications, further boosted investor confidence. In comparison, rival Stryker Corporation (SYK) has lagged behind BSX stock. SYK stock has gained 8.3% on a YTD basis and 8.2% over the past 52 weeks. Due to the stock’s strong performance over the past year, analysts remain bullish on BSX. The stock has a consensus rating of “Strong Buy” from the 32 analysts covering the stock, and the mean price target of $125.13 is a premium of 17.3% to current levels. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|