|

|||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Cooper Companies Stock Underperforming the S&P 500?/Cooper%20Companies%2C%20Inc_%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

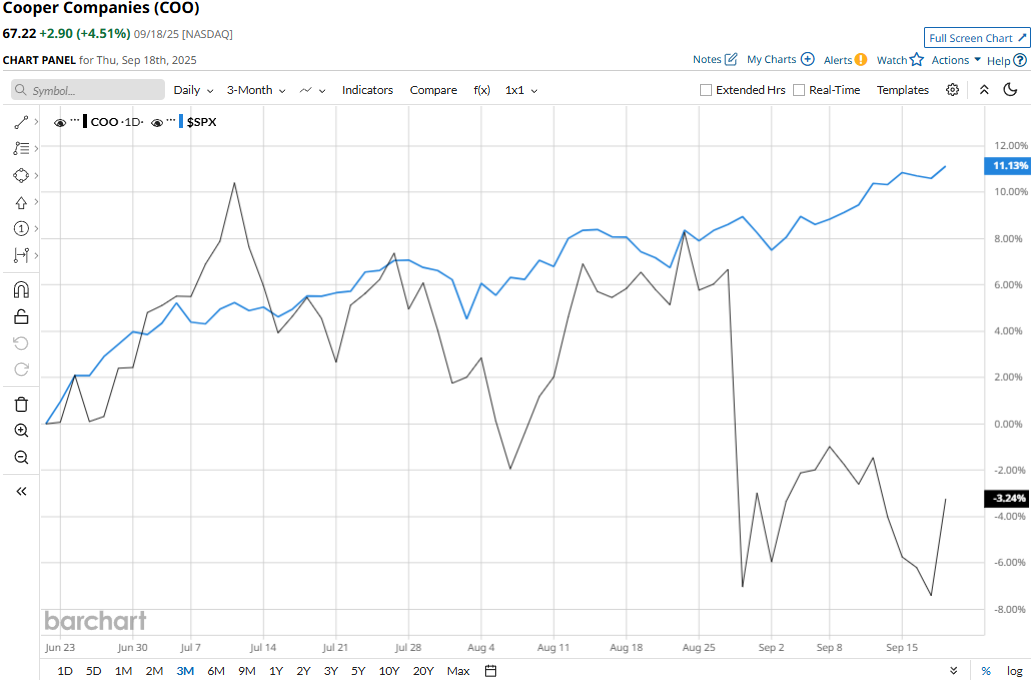

San Ramon, California-based The Cooper Companies, Inc. (COO) is a specialty medical device company. It operates through CooperVision and CooperSurgical segments. CooperVision manufactures and sells a wide range of contact lenses, and CooperSurgical sells a variety of medical devices and surgical instruments. With a market cap of $12.8 billion, Cooper’s operations span the Americas, Indo-Pacific, Europe, and internationally. Companies worth $10 billion or more are generally described as "large-cap stocks." COO fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the medical instruments & supplies industry. The stock touched its 52-week high of $112.29 on Sep. 19, 2024, and is currently trading 40.1% below that peak. Meanwhile, COO stock has dipped 3.7% over the past three months, underperforming the S&P 500 Index’s ($SPX) 10.9% gains during the same time frame.

Over the longer term, Cooper’s performance looks even more grim. The stock plummeted 26.9% on a YTD basis and 39.2% over the past 52 weeks, lagging behind SPX’s 12.8% surge in 2025 and 18% returns over the past year. Further, the stock has traded mostly below its 200-day moving average since mid-December 2024 and below its 50-day moving average since early November 2024, with some fluctuations.

Cooper Companies’ stock prices tanked 12.9% in a trading session following the release of its mixed Q3 results on Aug. 27. The company’s organic revenues grew by 2% compared to the year-ago quarter, which missed the Street’s expectations. Further, its overall sales came in at $1.1 billion, up 5.7% year-over-year and falling 50 bps short of expectations. Moreover, the company expects its Q4 results to remain soft, which unsettled investor confidence and led to the sell-off in stock prices. On the positive note, Cooper’s adjusted EPS increased 14.6% year-over-year to $1.10, surpassing the consensus estimates by 2.8%. When compared to its peer, COO has notably underperformed Hologic, Inc.’s (HOLX) 5.3% decline on a YTD basis and 16.5% plunge over the past 52 weeks. Among the 15 analysts covering the COO stock, the consensus rating is a “Moderate Buy.” Its mean price target of $83.28 suggests a 23.9% upside potential from current price levels. On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|