|

|||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Molina Healthcare Stock Underperforming the Nasdaq?/Molina%20Healthcare%20Inc%20location-by%20JHVEPhoto%20via%20Shutterstock.jpg)

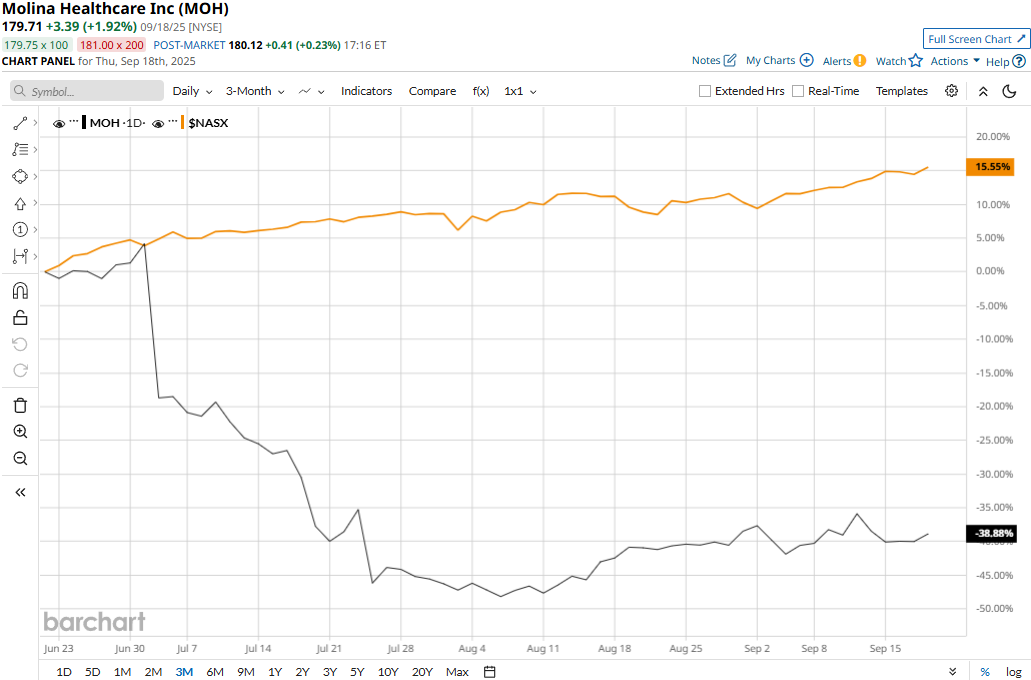

Long Beach, California-based Molina Healthcare, Inc. (MOH) provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces. With a market cap of $9.6 billion, Molina operates through Medicaid, Medicare, Marketplace, and Other segments and has operations spanning almost 20 U.S. states. Companies worth between $2 billion and $10 billion are generally referred to as “mid-cap stocks.” Molina fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the healthcare plans industry. Despite its notable strengths, Molina’s stock prices have plummeted 50.1% from its 52-week high of $359.97 touched on Apr. 4. Meanwhile, the stock has plunged 39.2% over the past three months, notably underperforming the Nasdaq Composite’s ($NASX) 15% surge during the same time frame.

Molina’s performance has remained grim over the longer term as well. MOH is down 38.3% on a YTD basis and 49.4% over the past 52 weeks, lagging behind NASX’s 16.4% uptick in 2025 and 27.9% surge over the past year. MOH stock has traded mostly below its 200-day and 50-day moving averages over the past year, with some fluctuations, underscoring its bearish trend.

Molina Healthcare’s stock prices tanked 16.8% in a single trading session following the release of its mixed Q2 results on Jul. 23. Driven by new contract wins, acquisitions, growing footprint, and rate increases, the company’s premium collections soared 15.1% compared to the year-ago quarter. Overall, the company’s topline came in at $11.4 billion, up 15.7% year-over-year and 5.4% ahead of the Street’s expectations. However, due to rising medical costs, the company’s margins took a severe hit, leading to a 6.5% decline in adjusted EPS to $5.48, missing the consensus estimates. Moreover, observing the rising medical expenses, the company reduced its full-year outlook, unsettling investor confidence. When compared to its peer, Molina has performed better than Centene Corporation’s (CNC) 46.9% decline in 2025 and 57.9% plunge over the past 52 weeks. Among the 17 analysts covering the MOH stock, the consensus rating is a “Hold.” Its mean price target of $189.43 suggests a modest 5.4% upside potential. On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|